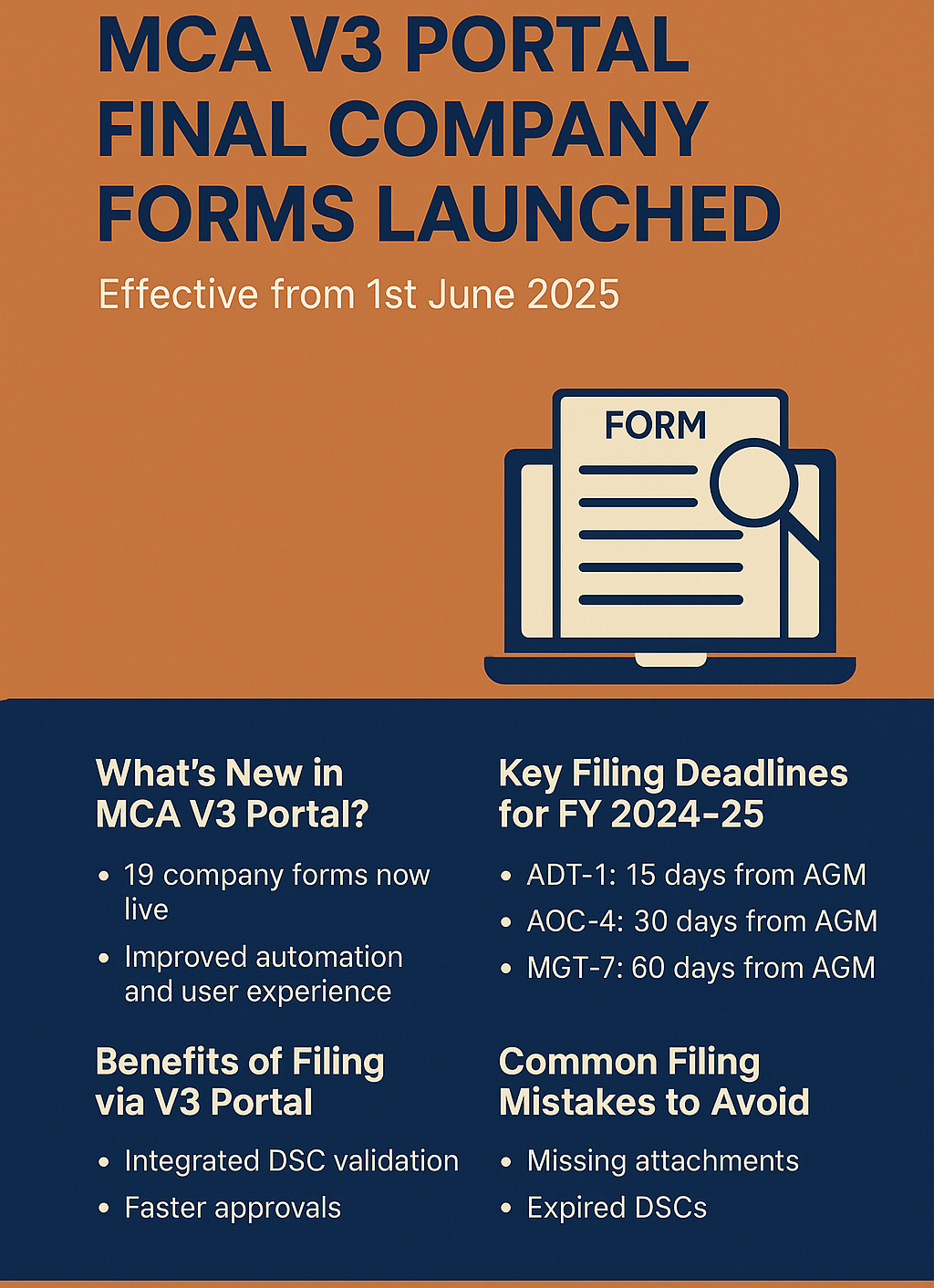

MCA V3 Portal – Final Company Forms & Key Filing Deadlines

The Ministry of Corporate Affairs (MCA) has taken a major step towards digital-first compliance by officially launching the final set of company forms on its upgraded MCA V3 Portal. Effective 1st June 2025, 19 forms—including 13 annual filing forms and 6 audit/cost audit forms—are now available for companies to file their statutory documents under the Companies Act, 2013. These changes bring improved speed, accuracy, and user experience to corporate compliance in India.

MINISTRY OF CORPORATE AFFAIRS

CA Prachi Gupta

8/6/20252 min read

📢 What’s New in MCA V3 Portal?

The MCA has successfully transitioned most statutory filings to the V3 Portal, offering improved automation, pre-filled data from master records, and faster processing. From 1st June 2025, the following forms are now active:

Annual Filing Forms include AOC-4, AOC-4 (NBFC), AOC-4 XBRL, AOC-4 CFS, MGT-7, MGT-7A, MGT-8, MGT-9, MGT-7LLP, MGT-6, MGT-10, MGT-14, and MGT-7C.

Audit and Cost Audit Forms include ADT-1, ADT-2, CRA-1, CRA-2, CRA-3, and CRA-4.

(Source: MCA Update dated 1st June 2025 – www.mca.gov.in)

📅 Key Filing Deadlines for FY 2024–25

For the current financial year, companies need to follow these timelines:

ADT-1 – For auditor appointment, filing is required within 15 days from the Annual General Meeting (AGM).

AOC-4 / AOC-4 XBRL – Financial statements must be filed within 30 days from the AGM.

MGT-7 / MGT-7A – Annual returns should be filed within 60 days from the AGM.

CRA Series – Cost audit-related forms have varying due dates depending on the specific form.

MGT-14 – Board resolutions must be filed within 30 days from the date of the resolution.

📌 Note: Most companies will hold their AGM by 30th September 2025, so filing deadlines should be calculated based on this date.

💡 Benefits of Filing via MCA V3 Portal

✅ Pre-filled data from MCA records for accuracy.

✅ Integrated DSC (Digital Signature Certificate) validation for smooth authentication.

✅ Faster approvals through backend automation.

✅ Updated user interface for improved navigation.

⚠️ Common Filing Mistakes to Avoid

❌ Submitting forms without mandatory attachments like board resolutions or audit reports.

❌ Using expired DSCs for directors, leading to last-minute delays.

❌ Entering incorrect CIN, PAN, or authorised signatory details.

👩💼 Expert Opinion

CA Prachi Gupta, Corporate Compliance Consultant, says:

“With these 19 forms now in place, the MCA V3 portal ensures complete digitisation of annual compliance. Companies, especially smaller firms unfamiliar with XBRL or cost audit formats, must start preparing early to avoid penalties.”

📌 Summary

Launch Date: 1st June 2025

Forms Available: 13 Annual Filing + 6 Audit/Cost Audit

Key Forms: AOC-4, MGT-7, ADT-1, CRA Series

Deadlines: 15–60 days post-AGM

❓ FAQs

Q1. Are these forms mandatory for FY 2024–25?

✅ Yes, they are mandatory for all filings from FY 2024–25 onwards.

Q2. What if I miss the deadline?

⚠️ Penalties apply under Sections 92 & 137 of the Companies Act, 2013, along with daily late fees.

Q3. Where can I access the forms?

🌐 All forms are available on the MCA V3 Portal.

Final Words

The launch of these 19 final company forms marks a big milestone in corporate compliance.

#mcaindia #mcaV3portal #companycompliance #annualfiling #aoc4 #mgt7 #craforms #corporatelaw #auditfiling #costaudit #companiesact2013 #indiabusiness #companylaw #statutorycompliance #legalcompliance #corporateupdates #businessindia #startupindia

My office

J C HEIGHTS 11, JAGDAMBA NAGAR E, HEERAPURA, AJMER ROAD, JAIPUR, RAJASTHAN

Contacts

prachiguptaassociates@gmail.com

+91 8766383062/ +91 9717591369

Chartered Accountants