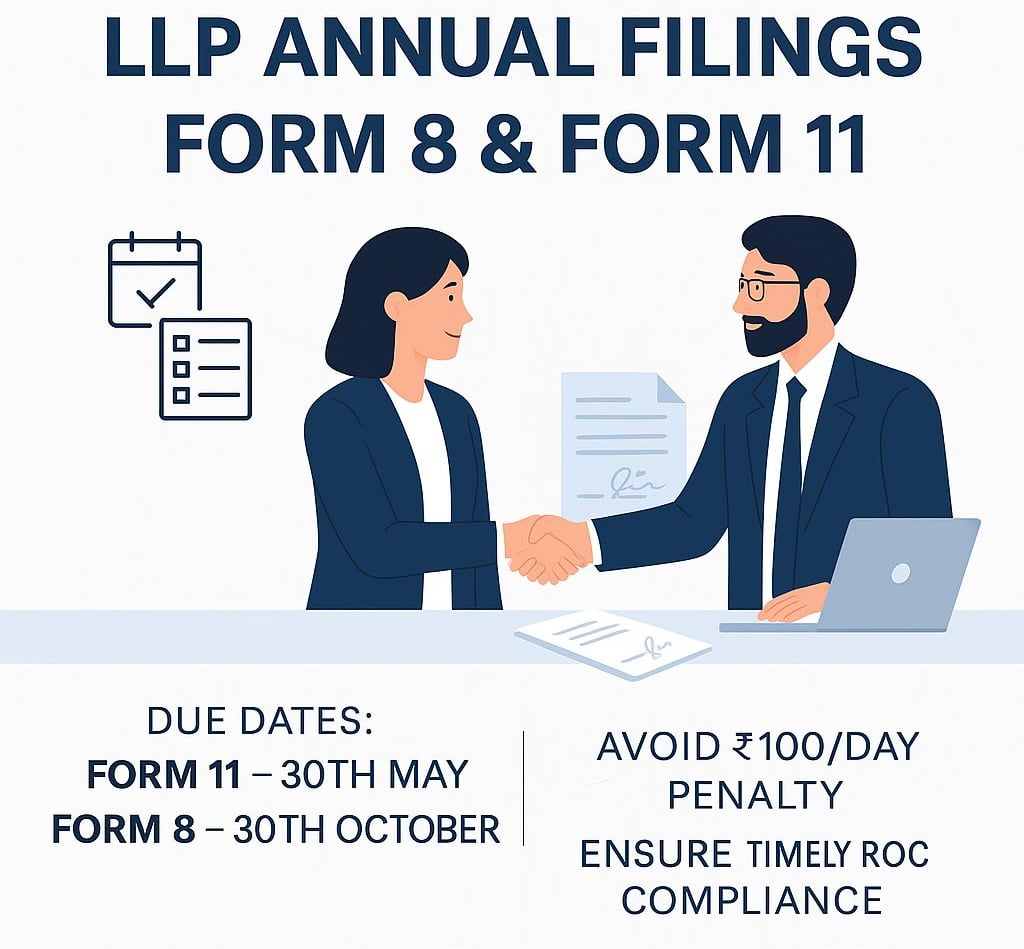

📌 LLP Annual Filings – Form 8 & Form 11

Due Date - 30th May, 2025

MINISTRY OF CORPORATE AFFAIRS

CA Prachi Gupta

5/27/20251 min read

📌 LLP Annual Filings – Form 8 & Form 11

🧾 A Practical Guide for Every Partner

As a practicing Chartered Accountant, I often hear —

“Madam, our LLP is inactive, do we still need to file?”

👉 Yes! Under the LLP Act, 2008, even if your LLP has zero turnover, you must file Form 8 & Form 11 every year with the ROC.

📝 Form 11 – Annual Return

🔹 Contains partner details, changes, and contribution

📅 Due Date: 30th May every year

✅ Must be filed even with no business activity

📊 Form 8 – Statement of Accounts & Solvency

🔹 Financial position of LLP

🔹 Solvency declaration by Designated Partners

📅 Due Date: 30th October every year

📌 Audit required if Turnover > ₹40L or Contribution > ₹25L

💡 Filing Process in 5 Simple Steps

🔐 Login to MCA Portal

📄 Download the relevant form

🖋️ Fill details + attach documents

🧾 DSC & professional attestation

📤 Submit + pay fees online

⚠️ Penalty Alert

❌ ₹100/day per form for late filing – no upper limit!

✨ Real Talk: Why You Should File Timely

💼 Stay compliant & avoid fines

📊 Build trust with investors, banks & clients

🤝 Safeguard partner credibility

📈 Focus on business growth, not regulatory panic

🧷 From My Desk at Prachi Gupta & Associates

Over the years, I’ve seen startups miss filings and pay thousands in fines just because no one informed them of this obligation.

Let’s change that – one post, one business at a time.

📩 Want help with Form 8 or 11?

Let’s get it done smoothly.

#LLPCompliance #Form8 #Form11 #LLPFiling #MCAFiling #ROCCompliance #StatutoryAudit #CharteredAccountantIndia #IncomeTaxAudit #BusinessCompliance #StartupIndia #IndiaBusiness #CAsOfIndia #TaxConsultant #AnnualReturn #LLPAct2008 #FileBeforeDueDate #AvoidPenalty #AccountingTips #FinancialYear2024 #PrachiGuptaAndAssociates #DSCFiling #MCAUpdates #LLPChecklist #ROCUpdates #TaxSeasonIndia

My office

J C HEIGHTS 11, JAGDAMBA NAGAR E, HEERAPURA, AJMER ROAD, JAIPUR, RAJASTHAN

Contacts

prachiguptaassociates@gmail.com

+91 8766383062/ +91 9717591369

Chartered Accountants